During the last month, we’ve seen a confluence of positives in some of the major macro variables. Most notably, Chairman Powell said on June 4th that the FOMC was prepared to act in response to the economic outlook, including the trade disputes with China and Mexico.[i] His comments suggested that interest rate cuts were on the horizon, sparking a 2.1% rally in the S&P 500 for the day.[ii] The rally marked the beginning of the recent turnaround in equities after the weakness we saw in May.

Arguably, the Fed outlook has been the most important macro variable of the last year. From our perspective, Powell’s comments on October 3rd that the fed funds rate was a long way from neutral catalyzed the beginning of the multi-month selloff in equities, and his pledge on January 4th that the Fed would be patient with any further rate increases laid the foundation for this year’s rally. [iii][iv] And now more recently, we have Powell seemingly coming to the stock market’s rescue.

During the last month, we’ve also seen positive developments on trade and Brexit.

Of course, Presidents Trump and Xi agreed to restart trade talks during the G20 meeting at the end of June. Trump promised to hold off on putting a 25% tariff on nearly $300 billion of Chinese imports, and he lifted some restrictions on Huawei. Meanwhile, Xi reportedly promised to start large scale purchases of American food and agricultural products.[v]

In addition to renewed hopes for a US-China trade deal, American and Mexican negotiators reached a deal on June 7th in which the Mexican government agreed to take new measures to curb the influx of Central American migrants into the United States. This averted new tariffs on Mexican imports.[vi]

There was also some good news on the Brexit issue. While Brexit still appears to be on track to occur by October 31st, Boris Johnson -- the frontrunner to become the UK’s next prime minister – has promised to cut personal income and corporate taxes. This follows Jeremy Hunt, another contender for Prime Minster May’s job, who wants to reduce the UK’s corporate tax rate from 19% to 12.5%.[vii]

As we’ve stated in the past, news during the last year of a Brexit divorce not occurring seems to have been received positively by financial markets. Nonetheless, we’ve believed that Brexit could happen without being disruptive to markets if it was combined with new, pro-growth policy measures. Major tax cuts (such as lowering the UK’s corporate tax in line with Ireland’s 12.5% rate) and new trade deals (Trump keeps dangling a major post-Brexit, US-UK trade deal) could be exactly the pro-growth package that turns Brexit from a market negative into a market positive.

The confluence of positives related to interest rates, trade and Brexit appear to have been the predominant catalysts behind the strong equity market performance in June. This begs the question, do we have clear skies for the remainder of the year? After all, it appears that we have a Fed that won’t be raising rates, the US and China will continue to negotiate their differences, and Brexit could go through more smoothly than expected.

To us, the latest macro developments are very encouraging. But the equity market outlook remains tricky, and we do not believe it’s a one-way ticket up in equities for the third and fourth quarters.

My biggest concern at the moment is the slowing global economy, which is permeating into the United States.

As we’ve shown in recent months, GDP for the major foreign economies (China, Japan, Germany and UK) has been slowing, while US GDP has been accelerating. But economic data at the margin suggests that the strength in the US could fade.

According to the Institute for Supply Management, the US Manufacturing PMI Index peaked at 60.9 last August, and June’s reading was 51.7 – down from 52.1 in May and 52.8 in April. [ix] Note, readings below 50 signal contraction in the manufacturing sector. We have warned that should this reading fall to 50 or less, the US economy will be at a heightened risk of entering recession.

It’s economic deterioration such as this that likely underpins the Fed’s motivation to reduce interest rates, despite the fact that the S&P 500 is trading near all-time highs.

As we see it, the good news is that June brought positive macro event catalysts, and holding all variables constant, one or two quarter-point rate cuts by the Fed could get the Treasury curve out of inversion. But the current inversion in the Treasury curve should be respected, and it will be important to see global economic growth stabilize after almost a year of deceleration.

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

*******

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Portfolios LLC can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

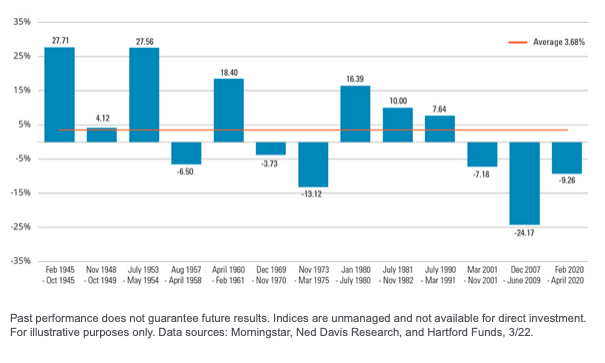

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

[i] “Stocks Jump as Fed’s Powell Suggests Rates Could Come Down”, by Jeanna Smialek and Matt Phillips, June 4, 2019, New York Times.

[ii] Ibid.

[iii] “Powell Says We’re a Long Way from Neutral on Interest Rates, Indicating More Hikes Are Coming”, by Jeff Cox, October 3, 2018, CNBC.

[iv] “Powell Says Fed ‘Will be Patient’ with Monetary Policy as It Watches How Economy Performs”, by Jeff Cox, January 4, 2019, CNBC.

[v] “Trump and Xi Agree to Restart Trade Talks, Avoiding Escalation in Tariff War”, by Peter Baker and Keith Bradsher, June 29, 2019, New York Times.

[vi] “Trump Announces Migration Deal with Mexico, Averting Threatened Tariffs”, by David Nakamura, John Wagner and Nick Miroff, June 7, 2019, Washington Post.

[vii] “Boris Johnson Promises Tax Cut for 3m Higher Earners”, by Rowena Mason, The Guardian, June 10, 2019.

[viii] Squawk Box, June 27, 2019, CNBC.

[ix] “US Factory Gauge Drops Less Than Forecast But Orders Stall”, by Katia Dmitrieva, July 1, 2019, Bloomberg.

[x] “US Services Gauge Drops to Lowest Since 2017”, by Jeff Kearns, July 3, 2019, Bloomberg.