By David Munn, CFP

President

Munn Wealth Management

Coming into 2022, the US economy appeared to be on solid footing. Gross Domestic Product (GDP) increased 6.9% in the fourth quarter of 2021, more than double its long-term average rate.

Now just six months later, the word “recession” is in more and more economic forecasts, analyses, and news coverage.

So what does recession mean? And more importantly, what does recession mean for investors?

During the vast majority of modern American history the economy has been growing. Technological advances and population growth are two main drivers of the consistent increase in production and overall economic activity (buying and selling goods and services).

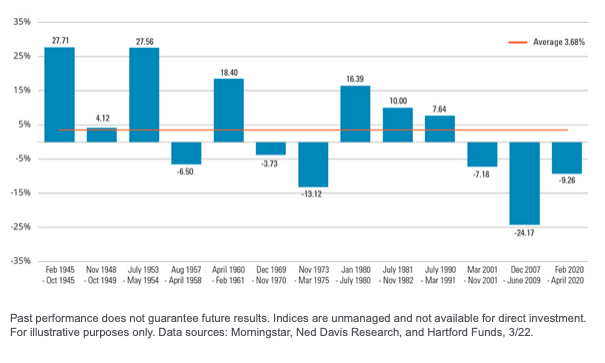

However, from time to time, the economy contracts, meaning that for a period of time, less is bought and sold than the previous year. When this contraction occurs over two consecutive quarters (GDP is measured quarterly), it is labeled a recession. Since 1945 there have been 13 recessions, which averages out to about one every 6 years.

A recession can be triggered by any number of factors: the 2001 recession was the popping of the tech bubble; the 2007-2009 “Great Recession” was the popping of the real estate bubble; the 2020 recession was COVID and subsequent global shutdowns.

So a recession is a normal part of an economic cycle and simply means the economy stops growing for a period of time.

As you would imagine, the stock market does not like recessions. Stock prices are based on an expectation of future profit growth, and while some select companies may continue to grow profit during a recession, most do not.

However, the stock market is forward looking and constantly pricing in available information. Many times the market will price in a current or future recession, even before the GDP data indicating a recession is available. Consequently, as the chart below shows, more often than not the stock market has actually produced positive returns during recessionary periods, though that has not been the case with the last three.

Earlier this year it was announced that GDP in the first quarter of 2022 decreased at a rate of 1.5%. That means if Q2 data also shows contraction, we will have experienced–or be in the midst of–a recession.

The data could also show growth in Q2, meaning we avoided a recession–for now. In either case, the market will likely not react, as it doesn’t care what happened in the past, and is focused on future economic conditions (which humans are very poor at predicting).

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels. The S&P 500 is an unmanaged index used as a general measure of market performance. You cannot invest directly in an index. Accordingly, performance results for investment indexes do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Munn Wealth Management is registered as an investment adviser with the United States Securities and Exchange Commission. 1323GKC